But many companies think that their software development projects might get assigned to unskilled professionals, resulting in low quality of work. Many companies based in the United States outsource their web development from India and other overseas locations, including popular outsourcing destinations like the Philippines and Vietnam. The main reason they do this is that they are saving money, taking advantage of India’s cost-effective public vs private accounting solutions. Outsourcing to India may pose data security concerns, especially if the outsourcing firm does not have the necessary data security measures in place. In the early 2000s, India emerged as the world’s leading outsourcing destination, with many global companies, including IBM, Accenture, and Microsoft, setting up their offshore operations in the country.

It’s essential to establish open lines of communication and encourage feedback to bridge any potential language-related gaps. By keeping the tips mentioned above to overcome outsourcing challenges and collaborating with the right outsourcing partner, getting success with outsourcing to India is certain. Considering the aforementioned advantages of outsourcing to India, no wonder why the country has become the preferred outsourcing destination for business across the globe.

Back office services

- Tech Mahindra is a software development, IT services, and consulting company based in Pune.

- To counter this congestion, the Indian government is offering several programs to encourage outsourcing companies to set up operations in emerging cities like Nasik, Chandigarh, and Ahmedabad.

- When outsourcing to India, any web design-related tasks or software development tasks that you are considering will be the lowest in price.

- India will always belong to the top options when it comes to the top outsourcing destinations.

- As establishing this in-house requires lots of time and other resources, it’s best to outsource it to Indian service providers.

Regular communication and progress reports can help to ensure that the outsourcing firm is delivering the desired quality of service. Sustainability has become a critical issue for businesses worldwide, and Indian outsourcing firms are no exception. This trend is driven by the growing awareness of the impact of climate change and the need for businesses to take action. Use the information shared in the article to understand how to outsource software development to the country and its benefits. With an NDA, you can legally bind the software development team to keep all project-related data confidential. An NDA is an agreement signed between the client company and its partner software development company.

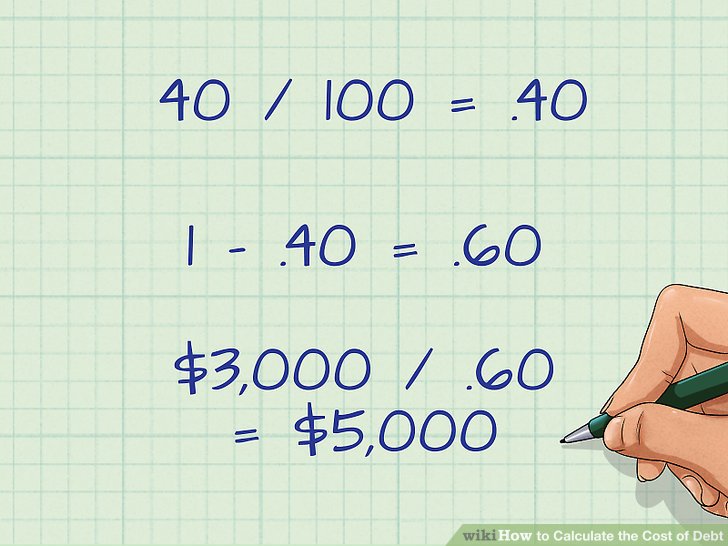

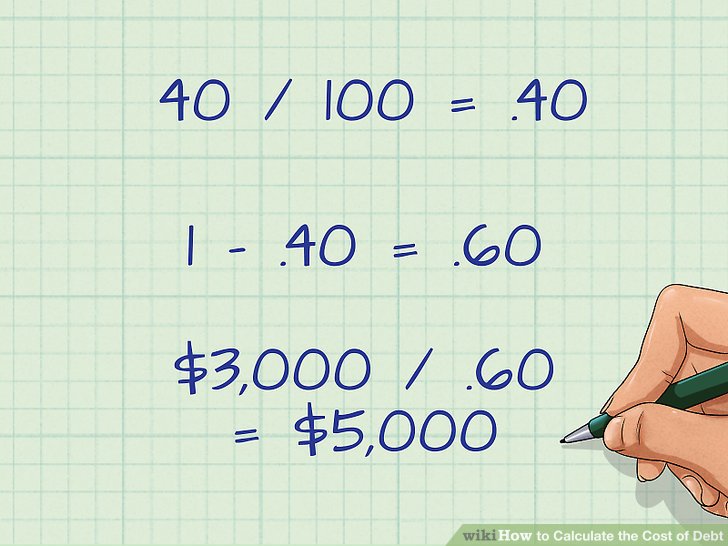

Hence, we are not in a hurry to explore talent from across borders,” says Rajkamal Vempati, Axis Bank’s Head of Human Resources. After all, you need to hold the service provider accountable for examples of fixed costs any delays or issues in the project. Communication plays a vital role in ensuring that your outsourced project is on track. You need tools that help you communicate project demands and progress to your remote teams. Like the Philippines, India has been a profitable outsourcing destination for hundreds of companies including Silicon Valley giants like Google and Facebook. And as most of these companies have been doing this for decades, you don’t have to worry about any dip in the quality of work.

Challenges and Concerns

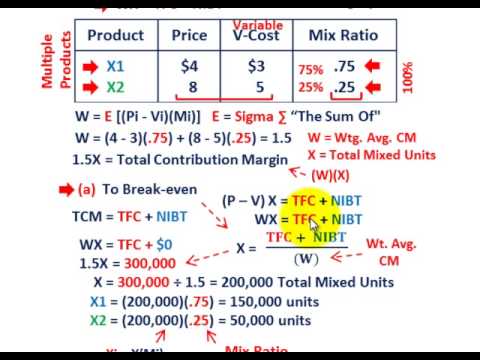

Most of global accounting standards them are well-versed with world-class business practices and the latest technologies to perform your tasks efficiently. This can, however, also be a benefit as it aligns well with the 24-hour operations trend and expedites project completion in sectors like IT and customer support. Cost reductions of up to 60–70% relative to in-house operations, especially with software development and IT solutions, are, nevertheless, not unusual. Graphic design, content creation, digital marketing – the talent pool here is deep, diverse, and brimming with innovation and startup energy. There’s the Philippines, known for its BPO prowess, Poland acing the IT sector, and Brazil making waves with creative projects, showcasing global business strategy at work. When outsourcing IT services or back-end tasks to India, comprehensive project details are crucial.

Who are these service providers?

In addition, India’s favorable exchange rate makes outsourcing even more cost-effective for businesses in countries like the United States and the United Kingdom. Despite some challenges and criticisms, such as concerns over data security and cultural differences, Indian outsourcing remains a popular practice for many companies worldwide. The outsourcing industry in India has become a crucial contributor to the country’s economy, providing jobs and generating foreign exchange earnings. Infosys is a next-generation software development company headquartered in Bangalore, offering IT solutions and digital marketing services.

Cost savings:

While IT outsourcing has been the dominant outsourcing service in India for several years, non-IT outsourcing services are expected to grow in popularity in the future. Outsourcing firms in India are expanding their services to include finance and accounting, human resources, and customer support, among others. This trend is driven by the need for businesses to outsource non-core functions to focus on their core competencies. Outsourcing to India is the practice of hiring a third-party company or individual in India to perform specific business tasks or functions for a company based outside of India.

It continues to attract global businesses due to its skilled workforce and cost advantages. India boasts a highly educated and skilled labour pool, which is a significant asset for outsourcing companies in India. This expertise, coupled with a strong focus on science, technology, engineering, and mathematics (STEM) education, ensures that Indian outsourcing partners can deliver top-notch services. From offshore software development to outsourcing IT projects, India’s workforce excels across the board. According to the latest outsourcing market analysis, India holds a substantial share of the global outsourcing industry.